Author Earnings

How much author earning do I earn for each eBook I sell?

You will earn 85 percentof eBook salesthrough the Book Country Bookstore, unless you purchase theProspect publishing package, which allows you to earn 100 percent.Thismeansif you publish using theSelf-Starter,Standard,LandmarkorDiscoverpublishing package,forevery dollar you generate through the Book Country Bookstore, you earn85 cents.You will alsoearn85 percentof the net payments if sold through another channel. Please bear in mind that this is 85 percent of what Book Country collects after the retailer has taken their transaction fee for each sale. This transaction fee varies store to store.

If you publish using the Prospect publishing package you will earn 100 percent author earnings. This means every dollar you generate through the Book Country Bookstore is yours. You will also receive 100 percent of the net payments if sold through another channel.

author earnings will not be paid on copies provided free of charge.

The exact amount you earn from each eBook you sell could differ depending onwhether the sale is made directly from Book Country or through another retailer. As this does get a bit confusing, here are two example scenarios:

Here's an example of a common sales transaction if you publish your eBook with Book Country:

The List Price for your book is $4.99.

The Retailer/Transaction Fee varies from vendor to vendor. (Book Country'sbookstore feeis 0% of the list price.)

With the Self-Starter, Standard, Landmark and Discover packages your author earning Rate through theBook Country Bookstoreis 85%. (You get 85 percent of the sales.)

With Prospect your author earning Rate through the Book Country Bookstore is 100%. (You get all of the sales.)

With the Self-Starter, Standard, Landmark and Discover packages your author earning Rate through channel partners (Amazon, Kobo, Apple, etc.) is 85% of net.

With Prospect your author earning Rate through channel partners (Amazon, Kobo, Apple, etc.) is 100% of net.

How much author earning you would earnif you made a sale through Book Country:

Book Country Bookstore

With Self-Starter, Standard, Landmark or Discover:

| List Price |

- |

Retailer/Transaction Fee |

= |

Net Sale |

x |

Author Earning Rate |

= |

Author Earning Earned |

| $4.99 |

- |

$0 |

= |

$4.99 |

x |

85% |

= |

$4.24 |

How much author earning you would earnif you made a sale through an outside retailer:

Sample Retailer

With Self-Starter, Standard, Landmark or Discover:

| List Price - |

Retailer/Transaction Fee* = |

Net Sale x |

Author Earning Rate = |

Author Earning Earned |

| $4.99- |

$1.50 = |

$3.49 x |

85% = |

$2.96 |

* Retailer transaction fees differ byretailer and currently range from 20%-65%. Some vendors also charge an additional fee per sale of $0.25 per book. For retail sales, Book Country does not take any of this fee - it all goes to the retailer.

*Note: The price of your book can also impact the author earning rate paid by the retailers. For example Barnes and Noble and Amazon both pay a lower author earning percentage on books priced below $2.99.

Back to top »

Where do I see my sales?

We'll help you track sales and author earning information in online reports in your Publishing Dashboard on theBook Country website.

Back to top »

What information is available in the online sales and author earning reports?

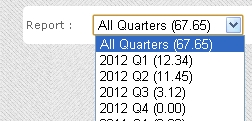

In the Sales Report and author earning Report tab of your Book Country Publishing Dashboard, you will be able to view a variety of information regarding sales of your eBook(s) and Author Earnings. You can export these reports as Excel or PDF files for your personal records.

- Sales Report: In the "Sales Report," we do our best to provide you with up-to-date information regarding your eBook sales. The goal here is to give you a good estimate of how and where your eBook is selling. You can sort sales data based on title, format, retailer, sale date, etc. You can also filter the sales data to create further customized reports.

We update this report for you as frequently and as accurately as we can. However, please notethat because external retailers operate on their own schedules, it can take time for them to report their sales information back to us. We’ll tell you what we know as quickly as possible, but at this stage in

the industry it’s not possible to get real time reporting across a broad

variety of sales channels.

- Author Earning Report: In the "Author Earning Report," we show you your finalized eBook sales for each quarter.

Back to top »

How long does it take for a sale to be listed in my online "Sales Report"?

The information in the "Sales Report" is updated throughout the author earning quarter to give you an idea of how welland where your eBook is selling. We always do our best to get accurate sales information to you as soon as we can, however this data cannot be updated in real time and may not reflect finalized information.

Sales made through outside retailers are updated monthly, within 60 days following the end of the month. Please note that external retailers - Apple, Amazon, Barnes and Noble, etc. - operate under their own schedules, so we cannot control the frequency with which they report sales information back to us. The information we receive from our retail partners may reflect only the month of sale, not the actual date. That means retailer sales will show up in your "Sales Report" as the first day of the month they are effective. For example, all of your sales made through Apple for the month ofMay 2013 will reflect a sales date of 5/1/2013 in the online reports.

Back to top »

How often is my "Author Earning Report" updated?

Because external retailers operate on their own schedule, it can take time for them to report their sales information back to us. This means it may take up to 60 days after the close of the Author Earnings quarter for sales information to be finalized and posted on your "Author Earning Report" in your publishing profile.

Back to top »

Will I still see an author earning statement if there were no sales ina quarter?

Once the statement for a quarter in which you have made no sales has been finalized, you will see the reporting period for that quarter available in the dropdown report menu with $0.00 indicated in parenthesis. If you choose to run that report, you will see a message that says "No sales reported for the period selected."

Back to top »

My friend said he ordered my book. Why don't I see this sale listed in my online "Sales Report"?

The answer to this question depends on where your friend ordered the book. If your friend ordered from the Book Country Bookstore, then the order will appear within three daysof the salebeing processed. If your friend ordered from another bookstore or retailer, the order will appear as soon as we receive monthly sales reports from our partners. Please note that because each retail partner operates under their own schedules, we cannot control when we receive this information from them.

Back to top »

Can you provide me with the names of customers who bought my book?

Industry practice, consumer privacy rules and Book Country business policy do not allow us to provide this information to you or to anyone else. While we and our retail partners protect the identities of individual customers, we do provide you with as many details as we can in your "Sales Report."

Back to top »

I have a specific question about my author earning and sales reports. Where can I go to get the answer?

If you have a specific question that is not addressed in our Frequently Asked Questions, please contact us at customersupport@publish.bookcountry.com.

Back to top »

I need to change my address. How can I do that?

If at any point you need to update your account information, you can do so on yourProfile page.

Your mailing address and phone number will always be kept private. For

most other information, you can control whether or not it appears on

your community profile for other members to see.

Back to top »

When am I paid Author Earnings?

You are paid for books sold each quarter after that quarter closes.*

First Quarter: January 1 to March 31 (payments available in late May)

Second Quarter: April 1 to June 30 (paymentsavailable in lateAugust)

Third Quarter: July 1 to September 30 (paymentsavailable in late November)

Fourth Quarter: October 1 to December 31 (paymentsavailable in late February)

* You are paid for the books sold in the given quarter time frame once you reach the threshold of $50.00 or more for payments by check or payments of $1 or more if you use EFT.

Back to top »

How do you pay me?

By default, your Author Earnings are paid by mailed check.

Or, you can opt in to the Electronic Funds Transfer (EFT) by adding your bank account information to your Book Country account. Simplylog-in to your accountand click on Profile to update your information.

Or, you can sign up for direct deposit by filling out and returning the form (download direct deposit form PDF).With EFT or direct deposit, instead of receiving mailed checks, your Author Earnings will be deposited into your bank account. Please note: If you are paid by check, a $5.00 check fee will be deducted from your Author Earnings; however, there is no fee for direct deposit or EFT payments.

If you choose to be paid by check, you will start receiving Author Earnings after the close of the first quarter that your Author Earnings for a book reach $50.00 or more. We will continue to hold your Author Earnings until the balance due to you is $50.00 or more, as stated in our Publishing Terms of Use. If you choose to be paid by EFT or direct deposit, you will start receiving Author Earnings the first quarter your earnings reach $1.00.

For each payment option, Author Earnings are sent quarterly (four payments per year).

Back to top »

When is my EFT information updated?

To ensure your author earning funds are transferred to your preferred account, please make sure your account information is accurate prior to these dates. Changes made after these dates will be reflected on the following pay cycle.

Back to top »

How long does it take to receive payment?

It takes about two months after the quarter closes until the Author Earnings are sent to you. First Quarter checks are mailed in late May, Second Quarter checks are mailed in late August, Third Quarter checks are mailed in late November, and Fourth Quarter checks are mailed in late February. (See specifics in the FAQs above.)

The two month timeframe is because we do not receive the reporting sales information until 30 days after the close of the quarter. Then, we need additional time to verify, compile and send the information to you.

Back to top »

Can my check be split between a co-author and myself?

By default, only you, the author/account holder, are paid author earnings. However,you can split your Author Earnings between two or more co-authors if you prefer. If you would like to arrange this, pleasecontacta Book Country representative.

Back to top »

Can I arrange for someone else to receive my Author Earnings?

Only if you transfer the entire rights of your agreement with Book Country to that person. That person will also hold the copyright for the book. If you would like to arrange this, please contact us.

Back to top »

Do I get Author Earnings when I purchase copies of my own book?

Any purchases you make of your own eBook - whether through a retailer or our website - will be treated as any other sale of your eBook.Thus, you will most certainly receive Author Earnings for each copy that you buy.In the end,it's basicallylike you'rereceiving an author discount.

Back to top »

I need to update my tax information. How can I do that?

You can fill out your W-9 or W-8BEN online through your Book Country account.

Back to top »

I've heard the term "royalty" and "author earnings." What's the difference?

Royalties are the monies paid to authors from traditional publishers after a book earns back its advance. (A royalty advance is a sum paid to an author when a traditional publishing house acquires a book. The publishing house works to earn that advance back, and if they do, they begin to pay the author royalties. For example, an author who receives a $5,000 advance will not start receiving author earnings until $5,001 worth of copies have been sold. If a traditionally published book never 'earns out', authors are not required to return the advance.)

Book Country Author earnings are the monies paid to authors after distribution fees of retailers and publishing partners are taken out.

The percentage of traditional author earnings is often lower (often 25% of net) than the percentage of author earnings (85%-100% net on Book Country) because of risk. The traditional publisher takes on financial risk for the books it publishes. A self-publisher is the one who takes on the risk (in terms of time spent working on the project, and any money put into the project -- for a cover, copyediting, etc.) and, therefore, receives a greater share of the book sales.

Book Country tries to mitigate the financial risk for authors interested in self-publishing by offering a free package with 85% of author earnings and a Prospect package of $399 for 100% author earnings.

Back to top »

Why does Book Country need my Social Security number?

We require your Social Security number to comply with the government's tax regulations. Since you have the opportunity to earn additional income from book sales, the government requires that you pay taxes on the total earnings. The W-9 form allows you to provide a Taxpayer Identification Number, or TIN. If you are publishing your book under your own name or a pen name, your TIN is your Social Security number. If you are publishing under a business name, or you want your author earning check to be addressed to a business, you can enter your employer identification number instead of your personal Social Security number.

If you do not supply your taxpayer ID number, we are required to withhold taxes at the rate of 28 percent of total earnings.

If you supply us with your taxpayer ID at a later date, we cannot return the withheld tax money because we do not retain it ― it is passed on to the government by law. You can speak to a tax professional about how to report this at the end of the tax year in order to receive a tax return for any additional amount that you are due.

Back to top »

I have more questions about taxes. What should I do?

Check out the Tax Information FAQs on our Tax Info page.